Expert Tips on How to Purchase Reverse Mortgage for Better Financial Stability

Expert Tips on How to Purchase Reverse Mortgage for Better Financial Stability

Blog Article

Empower Your Retirement: The Smart Means to Acquisition a Reverse Mortgage

As retirement strategies, many individuals seek reliable strategies to boost their financial freedom and health. Amongst these strategies, a reverse home loan emerges as a feasible alternative for homeowners aged 62 and older, allowing them to tap right into their home equity without the need of month-to-month repayments.

Comprehending Reverse Home Mortgages

Comprehending reverse home loans can be vital for property owners seeking financial versatility in retired life. A reverse home mortgage is a financial product that allows eligible homeowners, generally aged 62 and older, to transform a section of their home equity right into money. Unlike standard home loans, where customers make regular monthly repayments to a loan provider, reverse home loans allow property owners to obtain payments or a lump amount while maintaining possession of their residential or commercial property.

The amount available via a reverse home mortgage depends upon several factors, consisting of the house owner's age, the home's value, and current rates of interest. Notably, the financing does not have actually to be paid back until the house owner offers the home, moves out, or dies.

It is vital for potential customers to recognize the ramifications of this financial item, including the effect on estate inheritance, tax factors to consider, and ongoing responsibilities associated with residential property maintenance, tax obligations, and insurance coverage. Additionally, counseling sessions with accredited professionals are often called for to make sure that borrowers totally understand the terms and conditions of the lending. On the whole, a complete understanding of reverse mortgages can equip property owners to make informed decisions concerning their financial future in retirement.

Advantages of a Reverse Home Mortgage

A reverse home loan uses numerous compelling advantages for qualified property owners, specifically those in retirement. This financial tool permits seniors to convert a part of their home equity into cash, giving vital funds without the requirement for month-to-month home loan repayments. The money acquired can be made use of for numerous functions, such as covering medical costs, making home renovations, or supplementing retired life income, hence enhancing overall monetary versatility.

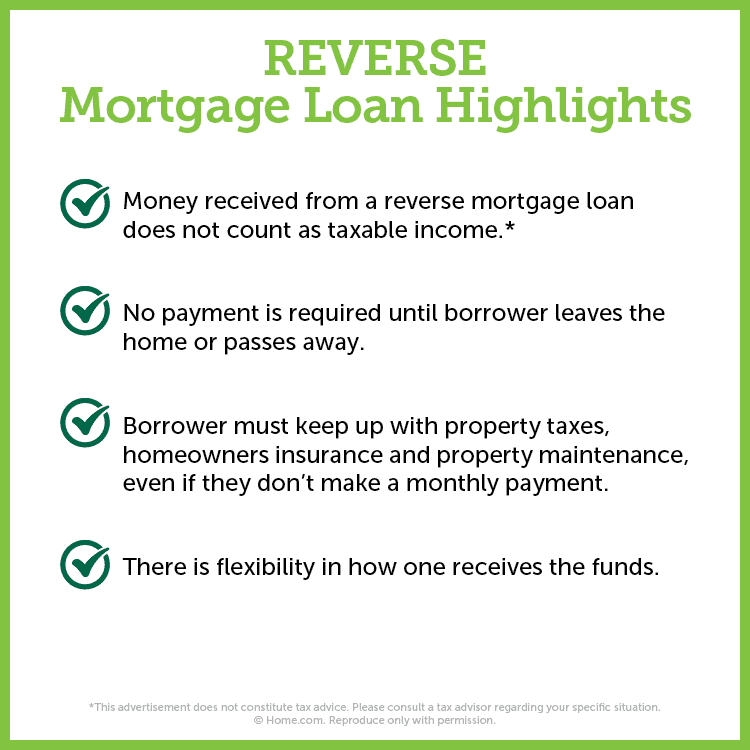

One considerable benefit of a reverse home loan is that it does not call for settlement till the homeowner vacates, offers the home, or dies - purchase reverse mortgage. This attribute makes it possible for senior citizens to keep their way of life and meet unforeseen expenses without the concern of regular monthly repayments. Furthermore, the funds gotten are commonly tax-free, permitting home owners to use their cash money without fear of tax effects

In addition, a reverse home mortgage can give satisfaction, recognizing that it can function as an economic security internet during challenging times. House owners also retain possession of their homes, guaranteeing they can continue staying in an acquainted environment. Eventually, a reverse mortgage can be a calculated monetary resource, empowering retired people to handle their finances efficiently while appreciating their golden years.

The Application Refine

Browsing the application process for a reverse home mortgage is a vital step for house owners considering this economic alternative. The very first stage involves assessing eligibility, which usually calls for the house owner to be at the very least 62 years of ages, own the property outright or have a low home mortgage balance, and occupy the home as their main home.

Once qualification is verified, homeowners have to undergo a counseling session with a HUD-approved therapist. This session makes sure that they fully comprehend the implications of a reverse home loan, including the duties included. purchase reverse mortgage. After finishing counseling, applicants can continue to collect required documents, including proof of revenue, properties, and the home's value

The next action entails submitting an application to a lending institution, that will analyze the financial and residential or commercial property certifications. An assessment of the home will likewise be performed to determine its market value. If authorized, the lender will certainly offer financing terms, which must be evaluated thoroughly.

Upon approval, the closing process complies with, where last files are authorized, and funds are disbursed. Recognizing each phase of this application procedure can dramatically enhance the property owner's confidence and decision-making relating to reverse home mortgages.

Secret Considerations Before Getting

Investing in a reverse home mortgage is a substantial economic choice that calls for mindful factor to consider of a number of essential elements. First, recognizing your qualification is critical. Homeowners have to be at least 62 years of ages, and the home needs to be their main residence. Examining your economic demands and goals is equally vital; figure out whether a reverse home mortgage lines up with your long-term strategies.

A reverse mortgage can impact your qualification for particular federal click here now government advantages, such as Medicaid. By completely assessing these factors to consider, you can make an extra educated decision about whether a reverse home mortgage is the ideal monetary method for your retirement.

Maximizing Your Funds

As soon as you have actually protected a reverse mortgage, effectively managing the funds comes to be a concern. The flexibility of a reverse home mortgage enables house owners to use the funds in various means, however strategic preparation is necessary to optimize their advantages.

One essential approach is to develop a budget plan home that details your regular monthly expenses and economic goals. By determining essential costs such as medical care, residential or commercial property tax obligations, and home maintenance, you can allot funds as necessary to make certain long-lasting sustainability. In addition, consider utilizing a portion of the funds for investments that can create earnings or appreciate gradually, such as common funds or dividend-paying stocks.

One more important aspect is to preserve a reserve. Reserving a get from your reverse mortgage can assist cover unanticipated costs, supplying comfort and financial stability. In addition, consult with a financial consultant to discover possible tax ramifications and exactly how to incorporate reverse mortgage funds into your general retired life approach.

Inevitably, sensible management of reverse mortgage funds can improve your monetary security, allowing you to enjoy your retirement years without the tension of monetary unpredictability. Cautious preparation and notified decision-making will make sure that your funds work efficiently for you.

Final Thought

In conclusion, a reverse home mortgage presents a viable financial method for seniors looking for to enhance their retired life experience. By converting home equity right into accessible funds, people can attend to essential great site costs and safe and secure added financial resources without incurring month-to-month payments.

Recognizing reverse mortgages can be critical for house owners looking for financial adaptability in retired life. A reverse home loan is a monetary item that allows eligible home owners, generally aged 62 and older, to transform a portion of their home equity into cash money. Unlike traditional home loans, where debtors make regular monthly payments to a loan provider, reverse home mortgages enable property owners to obtain payments or a lump amount while preserving ownership of their building.

In general, a detailed understanding of reverse home mortgages can encourage homeowners to make informed choices concerning their financial future in retirement.

Consult with a financial expert to discover feasible tax obligation implications and how to incorporate reverse home mortgage funds into your overall retired life approach.

Report this page